Finally Tax Relief - Now Pass Legislation to Make it Law

- Paul Martin Promised Lower Taxes in 2005 Budget Only to Cancel It

- Government Must Accept Opposition Motion to Delay Election

Vancouver:The Canadian Taxpayers Federation (CTF) reacted to the Economic and Fiscal Update delivered this afternoon by Finance Minister Ralph Goodale before the House of Commons Standing Committee on Finance in Ottawa.

Over the next six years, Ottawa's cumulative surpluses - including the annual $3-billion contingency reserve - will total $72.5-billion, according to independent forecasts contained in the economic update. The Finance Minister outlined proposals to provide $30 billion in tax relief over the next six years, including personal income tax relief of $325 for all taxpayers this year. A barrage of new spending initiatives on training, education, research and infrastructure was also unveiled.

"Today's massive surpluses are the result of one thing: A structural level of over-taxation levied on Canadians by the federal government. And so after fleecing millions of tax dollars in Adscam and spending billions more, the Liberal government has finally decided it is ready to lower taxes," said CTF federal director John Williamson.

"Bravo! But for this policy conversion to be meaningful, the prime minister must immediately table legislation to make it law of the land. This means accepting the opposition motion to delay the federal election until early January," noted Williamson.

Overtaxed Canadians Clap with One Hand:

"The Martin government should not expect too loud a cheer from taxpayers. After all, taxes have increased faster than incomes under the minority Liberal government. Ottawa is only returning the surplus to the people who created it, overtaxed Canadians," noted Williamson.

"It is well and good that the annual basic personal exemption will immediately be increased by $500 and that the lowest personal income tax bracket will be lowered to 15 per cent from 16 per cent. These changes will benefit all individual taxpayers," said Williamson. "However, the plan to drop the two middle income tax rates of 26 per cent and 22 per cent by 1 per cent each in 2010 is too far away; as is increasing the threshold at which the top rate of 29 per cent begins to apply to $200,000."

"With the Liberals about to be fed to the sharks, they are finally hearing the calls from taxpayers for lower taxes," concluded Williamson. "The government has discovered that millions of Canadians want lower taxes and those voters have not disappeared."

Federal Spending Not Sustainable:

A recent Global Insight report by economist Dale Orr found that the minority Liberal government has spent three-quarters of $44-billion in unanticipated budget surpluses, leaving only 17 per cent for debt reduction, and just 9 per cent for tax relief. It concluded the government has "lost its balance."

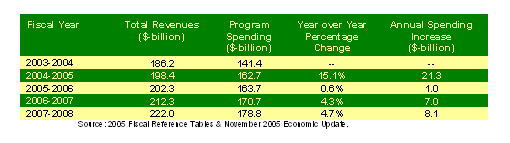

"This is not a government that has acted responsibly," observed Williamson. "The federal government began increasing spending at an alarming rate in 1998 soon after the budget was balanced. Yet things went off the rail last year when Ottawa's program spending jumped by an astounding 15 per cent. That amounts to a $21.3-billion increase, which can only be described as irresponsible and reckless."

"According to today's economic update, program spending will increase this year by less than one per cent. That's well and good. But in the 2004 budget, Mr. Goodale said program spending in 2004/05 would increase by 3.1 per cent. It increased by 15 per cent," concluded Williamson. "Again, let's not get terribly excited about the government's dedication to control spending. It's all been heard before and it is no accident it is being heard again on the eve of an election."